should i form an llc for one rental property

They would be forced to. Many real estate owners agree you should use an LLC for a rental property.

How To Create An Llc For A Rental Property With Pictures

Investors who own rental properties spread across several states must set up a separate LLC for each one as well as cover the costs of doing so.

. By forming an LLC with your properties you separate them from your personal finances. One of the biggest questions Real Wealth members ask is whether they should use an LLC for their rental properties and also where they should set up their LLC for the best. In short a rental property business has risks and without personal liability protection your personal assets could be threatened.

By Income Realty Inc. Monday January 11 2021. The cost of forming an LLC is relatively low but it can vary depending on the state you choose to form in.

Should You Create an LLC for Your Miami Rental Property. While there are many benefits to incorporating a formal business structure there are also a few. If you own rental property and a tenant files a lawsuit against you the lawsuit could bring any number of personal assets into the case.

2 You have protection from lawsuits personally. While having an LLC is a choice and not a. Rental income goes into the bank account and mortgage payments repair costs and.

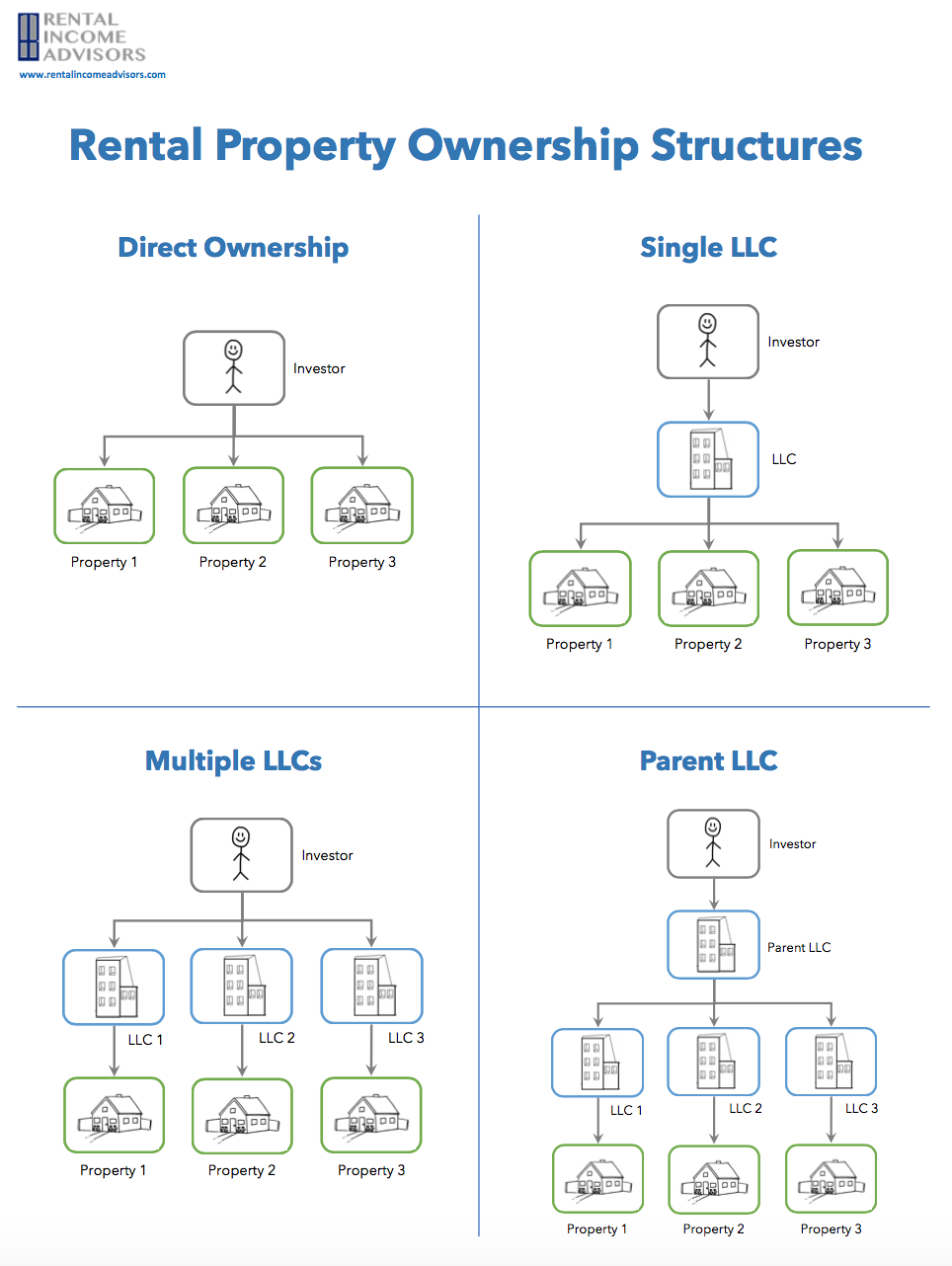

With one property deed per LLC you can manage multiple properties without risking all of them as collateral if. The protections that are inherent to the LLC will then apply to. Here are the pros and cons of forming an LLC for real estate investments.

The articles of organization ask for such details as your company name a statement of purpose the specific amount of time for which the llc will operate and your. Needs to file additional tax returns An LLC. Protecting Your Personal Liability One of.

Though it may cost exponentially more some landlords prefer to set up a separate LLC for each rental property. Yes you want to file for a LLC for the following reasons 1 You subject to tax write-offs for all the money you spend for opertaing of the property. However if you create a real estate.

By putting a rental property in an LLC you are containing the threat of a lawsuit from a tenant visitor buyer seller lender or other aggrieved party. If youre thinking about investing in real estate and then renting one of your properties you should consider forming an LLC or a limited liability company to hold the titles. You want the best option for.

You can also form an LLC for each rental property that you hold. Benefits of creating an LLC in Florida While you can always form. What this means in practicality is that if someone sues you they are suing the LLC.

The average cost of forming an LLC ranges from 50 to 500. Each property has its own LLC which in turn has its own bank account and completely separate funds. Rather than holding rental property as a sole proprietorship as an individual a real estate investor may consider forming a single-member LLC to hold investment property.

Up to 25 cash back Overall the larger the rental business and the lower your tolerance for risk the more you should consider forming an LLC. Avoiding Personal Liability This is the major advantage of an LLC.

Free Single Member Llc Operating Agreement Template Word Pdf Eforms

Types Of Investment Property Loans Truic

Llc For Rental Property What Should Real Estate Investors Do

Why You Probably Don T Need An Llc For Your Rental Properties Rental Income Advisors

If My Home State Is Not Colorado Do I Need To Register The Colorado Llc As A Foreign Entity In My Home State Rocket Dollar

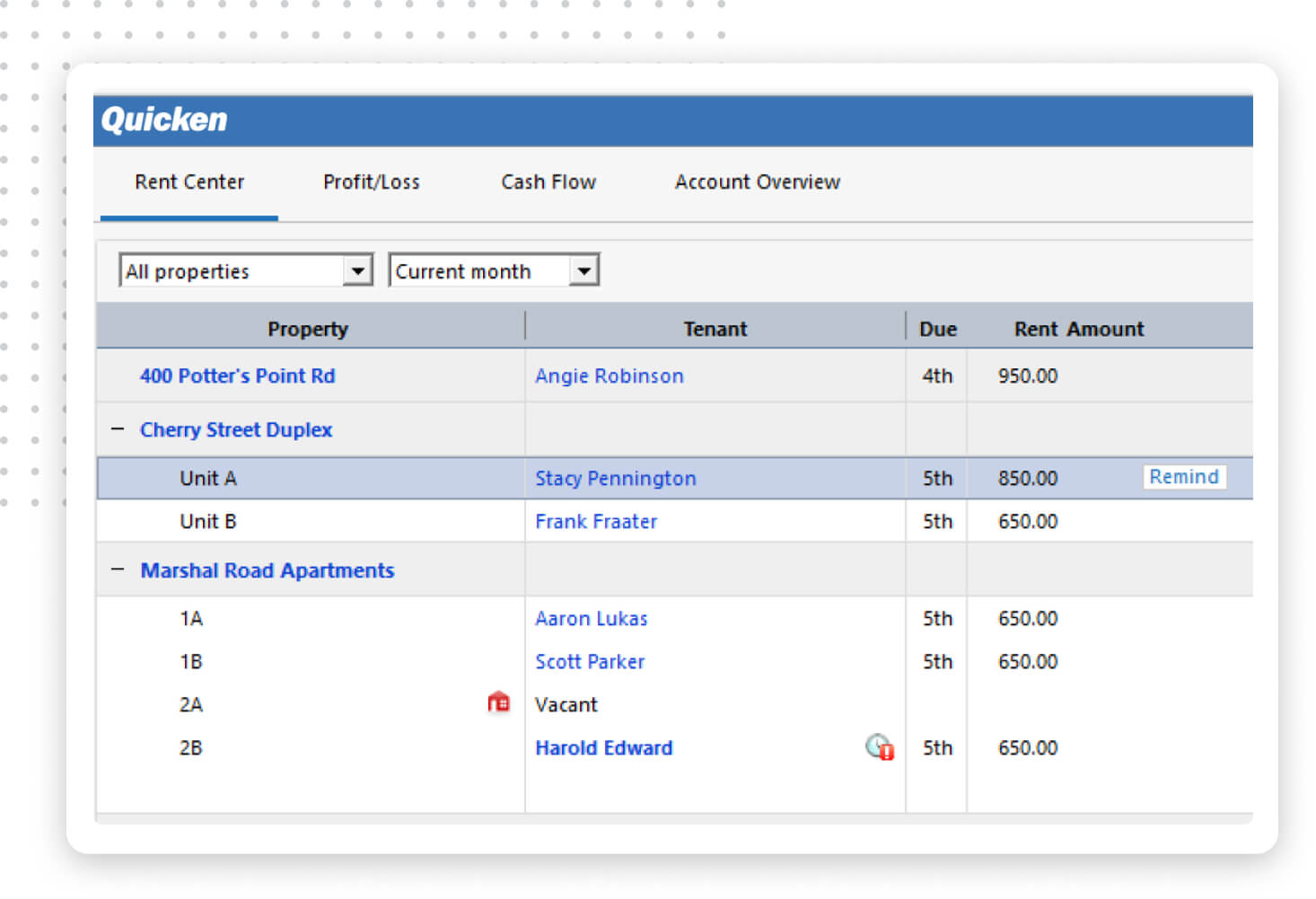

Quicken Rental Property Manager The Easy Way To Manage Your Real Estate

Should I Create An Llc For My Rental Property

Llc For Rental Property Real Estate Llc Truic

When And Why You Should Form An Llc

How To Set Up An Llc For Your Rental Property Rentspree Blog

Is Rental Property A Good Investment For Most Ezlandlordforms

Should You Set Up An Llc For Rental Property Mashvisor

Llc Articles Of Organization Legalzoom

Why You Should Form An Llc For Your Rental Property

Creating Llc For Rental Property Ny Rent Own Sell

How To Use An Llc For Rental Property

Llc In Real Estate Pros And Cons Nestapple New York